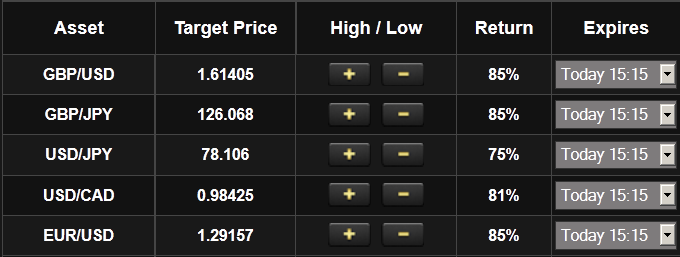

One nice feature in binary options trading is that broker platforms will generally show the profit percentage a trade is capable of generating if the final outcome is positive and your original price direction (either a CALL or a PUT) proves to be accurate. These percentages are then added to the investment amount and this creates the total binary options payout for the trade.

Binary Options Payout

For example, let’s say we place a trade with $1,000 and the winning stake that is associated with the position is 80%. If the trade closes in our favor (in the money) the payout is $1,000 + (80% of $1,000) = $1,800.* In this case, the payout for the trade would be $1,800. The max payout for your trade will be clearly visible on your platform, in most cases. In the graphic below, the trading payout would be equal to 70%.

*Amount to be credited to account for a successful trade.

Binary Investment

Perhaps the most important part of getting ready for binary options is finding the very best return on your investment. Your return on investment (ROI) is sometimes even more important than which underlying asset you end up selecting. A high ROI can offset the knowledge gap that you have concerning an asset if it is substantial. For example, if you are trading an underlying asset with a 65 percent correct trade rate and you are getting a 70 percent ROI when you are successful, you can easily find a better ROI and start making more money with a lower correct trade rate.

The way it works is quite simple. You need to find a ROI that is high enough so that even if you are wrong a few more times per 100 trades, you are making a higher rate of return when you are right. There are binary options brokers out there that offer better rates on some of the lesser traded assets in order to lure traders toward them. Finding these assets can play a vital role in increasing the amount of money you make trading binary options.

The first step that you need to take is to compare and contrast between different brokers. If you are comfortable trading U.S. stocks, look around between the major online binary options brokers, demo account trade and find which one presents you with the highest ROI. There are many binary options brokers out there and they are all competing for your business. You should always trade with the broker that gives you the most money. This might mean that you need to have an account with more than one broker as rates can often vary from day to day. If Broker ABC has a higher rate of return than Broker XYZ, you obviously want to go with ABC. However, XYZ might have a higher ROI for the same underlying asset a few days later. Spreading your bankroll out between these different brokers will give you the most flexibility and will ultimately make your profit rate a bit higher.

The second method is to compare assets within the same broker. This step is vital for two types of traders. First, the trader who is crunched for time needs to do this in order to make sure that they are getting the highest rate of return on their money. If you do not have enough time to skim through several different brokers, sticking with a single broker will help you out without having to go to several different brokers’ sites. The second type of trader that will want to use this technique are those individuals with a smaller bankroll. If you cannot effectively spread your money out between three or more brokers, sticking to a single broker can still be profitable for you. You need to get over the notion that you can only trade one asset however. If you are familiar with technical analysis methods for short term trading, trading a different type of asset will not be a huge stretch as the principles that govern one underlying asset are easily translated to another.

Having a high ROI can also be accomplished via a third method. Some brokers offer rebates on unsuccessful trades—some as high as 15 percent. If you are wrong occasionally this will end up paying off for you. The best way to figure out if this will benefit you is to calculate your correct trade rate. If you are right 60 percent of the time, this means you are wrong 40 percent of the time. Figure out what your average rate of return is and then do the math to see if the 15 percent rebate will help you out here.

Let’s look at a quick example. Assume you have a correct trade rate of 60 percent with an average return of 72 percent. If you have a 15 percent rebate on your incorrect trades, this means that 40 percent of the time, you are gaining 15 percent of your original investment back. The math for a standard trading amount of $100 over the course of 100 trades looks like this:

(60×172) + (40×15)

This gives you a return of $10,920, or a profit of $920.

If you are trading at a correct trade rate of 63 percent without a rebate, you might think that your higher correct trade rate will help you out more, but the math says something different. Assume the same 72 percent ROI. The math looks like this:

(63×172) + (32×0)

This gives you a return of $10,836, or a profit of $836. As you can see, despite your better correct trade rate, you are still not making as much money as you would with a rebate. The difference might be slight, but over a period of time this is money lost. Finding out your correct trade rate, then, is an essential part of your long term success with binary options.

Highest Payout in Binary Trading

One thing that must be initially understood is that different options contracts will have different binary options payout rates. You need to make sure that you get the best binary options education before you pick your assets and instruments. So, getting an above average payout in one trade does not mean that this will be repeated in the next trade. For the most part, contracts in binary options will have payout rates of between 60% and 90%, so if you do come across rates that are below this, you should consider using another broker. In some cases, brokers will allow traders to get a partial refund** on their investment if a trade ends out of the money. Read more about this topic in our article called itm and otm meaning or study further in our articles series called binary options for dummies.

The percentages for these refunds are generally low, and will be subtracted from the amount invested. Some traders will choose not to receive these refunds and this will also affect the potential binary options payout rates. When choosing the full payout option, the following changes might be seen:

Refund : 70% payout with a 15% refund possibility in an 85% profit trade.

Full Payout: 85% payout with a 0% refund possibility in an 85% payout profit trade.

**Not all binary options trading brokers offer this.

In some cases, you will see High Yield binary options contracts (such as High Yield Touch No Touch Binary Options or High Yield Boundary) which will offer substantially higher payouts – sometimes as high as 500%. But these trades will also be associated with more trading restrictions in place to protect the broker.

Is the Payout Different Depending on the Country?

The short answer is no. The payout doesn’t relate to the country or your residence but more about the instrument you trade. The more risky you plan to trade the higher payouts you can expect. Where there is a bigger risk there is also a bigger reward. Trading slow moving commodities or bonds is more stable generally speaking and forex trading is considered more high risk as especially smaller currency pairs can drop a lot in value in a single day.

Which Binary Options Payouts Should You Choose?

It is common to see new traders attempt to hit the “jackpot” with one trade that has a massive binary options payout, while others will look to build their accounts with a series of smaller payouts and various binary options trading strategies. So, which approach is the best choice?

Let’s look at two hypothetical examples. Trader A is looking for massive returns that enable him to quickly multiply his account size. Trader B is more conservative in approach and looks to build on small trades. The eventual goal is the same (multiplying the account), but the number of trades this will take is much larger. The question: Which trader is like to achieve the goal first? The answer, unfortunately, is that both traders have a chance of achieving the goal first. There is simply no way of knowing with guaranteed certainty if a trade will work out favourably.

So, then, is it impossible to decide on a method or pattern? Not exactly. Let’s assume that in both cases, the first trade works out favourably. Trader A achieves his goal and Trader B is now forced to repeat the process many times to catch up. Game, Set, Match: Trader A. But what if the reverse happens? What if the market experiences an unpredictable rise in volatility and both trades finish in the red? Now, trader A has his entire account depleted while Trader B (though bruised) will live to trade another day. If there were situations where market outcomes were 100% guaranteed, Trader A would have the best approach. Since this is not the case, most experienced traders would argue that Trader B’s conservative approach is preferable. If you are keen on learning more you can read more in our binary options trading course online.

Conclusion: Carefully Construct Your Options Payouts and Consider a Conservative Approach

It is important to understand how binary options payouts are calculated so that you can develop a trading plan that can build your trading account over time. Certain factors (like opting for a partial refund) can influence the potential gains you can make while also giving you some added protection against substantial trading losses. All of these factors can be considered when constructing a conservative approach that allows you to improve your trading numbers over time, rather than looking to hit the “jackpot” trade on a single occasion.

It is also important that scam brokers will prevent you from winning so avoid brokers on our binary options blacklist by all means. If you receive an email with offers that sounds too good to be true. They most likely are.