Many new traders are familiar with the most common form of binary options, where we simply make a prediction on whether the price of an asset will increase (in CALL options) or decline (in PUT options). But once binary options traders have some experience with these instruments, many look to more advanced trading methods in order to get an edge on the market.

One of these concepts is called Boundary trading, though sometimes the terms “Tunnel” trading or Range Binaries are also used.

Boundary Options Defined

Essentially, boundary option allow binary options traders to speculate on the possibility that an asset’s prices will be confined within a range over a predetermined period of time. So, for example, if we believe that Alcoa stock will trade between $9 and $10 for the next month, we could enter into a Boundary options contract using $9 and $10 as the strike prices, and one month as the expiration time.

If prices close within this predetermined range in one month, the trade will generate gains. If prices fall above or below this range, however, the trade will finish “out of the money.”

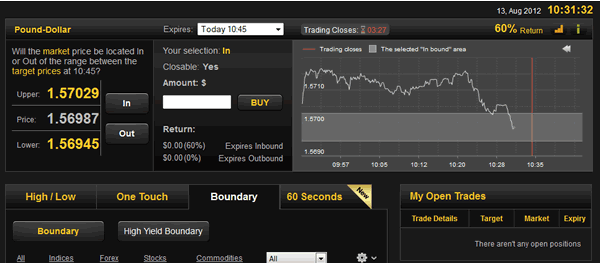

In the graphic below, we can see what this would look like on a real-time binary options trading station. In this example, the traded asset is the GBP/USD currency pair. The strike prices are: 1.5702 (on the top side) and 1.5694 (on the bottom side). Since this is a relatively small trading range, the expiration time is short term (15 minutes). On most platforms, the expiration time can be found in the “Expires” box.

In an example like the one shown above, we will want prices to hold inside the grey asset price box (defined by the upper and lower strike prices), as the time frame crosses over the red line (which marks the expiration of the contract). Here, the payout will be 60%* is these parameter requirements are met. These payouts, however, will vary depending on the broker that is used and the underlying asset that is traded.

*Amount credited to your account with a successful trade.

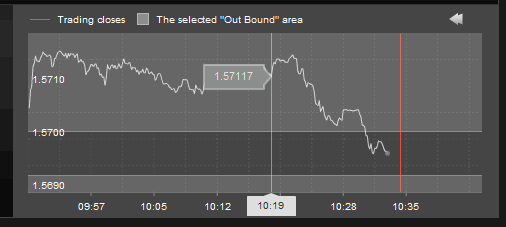

If prices cross over the red line as they are outside the grey boxed area, the trade would finish “out of the money.” An example of this can be seen in the chart graphic below:

The scenario shown in this graphic would represent the “worst case scenario,” as prices move outside of the boundaries in our original forecast.

Trading Outside the Boundaries

But this is not the only way Boundary options can be used. Another strategy is to look for prices to trade outside of a predetermined range. For example, let’s say that we believe Alcoa will not trade between $9 and $10 in the next month. This essentially means we believe that prices will either be below $9 or above $10 by the end of this month. In this case, the trade would be profitable as long as prices are not caught inside this predetermined price range.

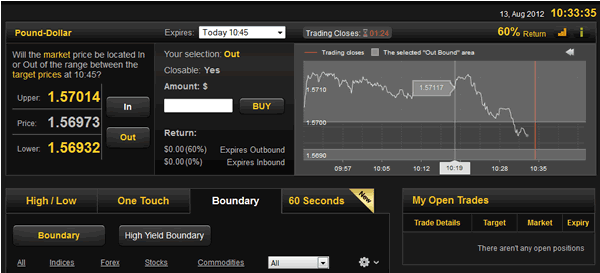

Below is another example using the GBP/USD. But this time, we are looking for prices to trade outside of our strike prices (the grey box) by the time of contract expiration:

In this example, trade would have been profitable because prices closed outside the grey box (defined by our original strike prices). Of course, if

prices had closed inside these strike prices, the trade would have finished “out of the money.”

An Alternate Method That’s Growing in Popularity

As binary options traders become more knowledgeable of the various contract types that are available, Boundary options trading has steadily grown in popularity. One of the best ways to profit from this method is to focus on the underlying volatility (changes in price) that can be found in the markets.

For example, if you believe that volatility will increase to a high level, it makes sense to trade outside of your chosen underlying asset price boundary.

Conversely, if you believe that markets will consolidate and decline in volatility, it makes sense to set a trade on the expectation that prices will remain contained within your boundary. Boundary option offer an attractive alternative to simple up and down binaries and can allow traders to express a very different view of the markets.